skip to main |

skip to sidebar

The idea talked about earlier, of cutting when trade is not within certain parameters (in this case 6 bars from the trigger) has borne fruit, as Dax has come off sharply on the back of Mortgage delinquency figures in the US.

The idea talked about earlier, of cutting when trade is not within certain parameters (in this case 6 bars from the trigger) has borne fruit, as Dax has come off sharply on the back of Mortgage delinquency figures in the US.

In the very short term it's possible to see a reaction from current levels, but i'd still favour the short side on a strategic basis.

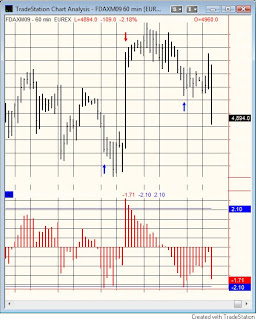

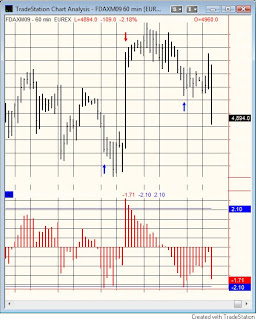

On a tactical one though I might go long if the hourly stats print another buy>> right now still some way away from that, but since the current Standard Deviation is -1.66, and the target to print a signal is +/-2.10STD, we are not a million miles away from it.

Chart above shows the last three trade set ups on what is a short to medium term time frame (hourly bars, so moves are expected to last between 2 to 3 days). The bars below the graph relate to the statistical measure i use to pinpoint areas of possible exhaustion. I've placed arrows on the chart to point to the occasions where the stats gave a buy or a sell signal. As is clear, the market did eventually do what it was supposed to, but not within the time limit allocated to each trade, and hence both the first buy and the sell where cut at a small loss.

The third signal was hit last night on the 9pm close of the futures, and called for a rally or sideways move that was to last a minimum of 6-8 bars. Mkt has not rallied this am, indeed although it showed some promise to begin with, the time limit within which the move should have occurred has now passed, and the potential for this set up is much diminished. Could the same thing as the previous two signals happen, so that the expected move is seen later than the allocated time frame allows? Yes it could, but the balance of probabilities points to a failure of the move, thus at this time one would have to be flat, waiting for another set up.

What do you do when bond prices are cratering, and stocks stand firm? You worry, that's what, and of course go short stocks as if your if your life depended on it... which of course it probably does right now. Zero Hedge has the story (click on story's title for link), and has done some sterling work pinpointing the mess in the US fixed income market.

What do you do when bond prices are cratering, and stocks stand firm? You worry, that's what, and of course go short stocks as if your if your life depended on it... which of course it probably does right now. Zero Hedge has the story (click on story's title for link), and has done some sterling work pinpointing the mess in the US fixed income market.

In a floating exchange rate system any attempt to devalue out of trouble (sounds familiar?) is met by the market punishing you with higher rates. If that what is happening now in US bonds, the result will not be pretty. When is the market spooked enough to go from worry to panic?

Stampede anyone?

German MPs under fire for Twitter leak

Sell set up after the spike yesterday afternoon has not done what it should have, so as written earlier I'm out. The move should occur within 6-8 time frames (in this case hours), and when the expected action does not materialise you know something is not right.

Sell set up after the spike yesterday afternoon has not done what it should have, so as written earlier I'm out. The move should occur within 6-8 time frames (in this case hours), and when the expected action does not materialise you know something is not right.

At this point in time the measure (bars below the Dax chart) has fallen from extreme levels reached yesterday, to more neutral ones now. That is not to say that a steep fall could not happen, just that the edge is not there any longer, and the signal strength has deteriorated to the point that the risk/reward profile of the trade does not warrant pulling the trigger.

I'm short via Sep puts, because I think the wall of worry the mkt has climbed is about run out of space, so cannot bring myself to buy a strategic long term position at these levels, the type of economic data points being released are still pretty bad. I am cognisant that stock market functions as a discounting machine, but methinks they are blind to what awaits us going forward. The debt mountain is still there.

Closed out the short put on yesterday afternoon, -0.15% loss. Strictly speaking I should wait until 9am today, but signal is rapidly running out of time, and not wiling to run this any further. Will wait for the cash open and then reassess.

Sabre rattling in Korea not helpful you'd think. Markets seems to be unimpressed for now, European futures are flat to small up from the 9pm close last night, bonds and $ pretty flat as well. Overall mkts are not overly worried about this, but are they right?

Horse racing, very much similar to trading. This is an interesting topic, and one that I started to look into when I was part of a group of people who discussed trading, music, BBQ and other topics on the way to mutual benefit and self improvement. The fact that I no longer read or am part of that group does not detract from the benefit of those ideas, indeed they continue to provide a strong rudder in heavy seas. ***

My method is based on the interaction between different asset classes, and on what happens when one of the assets moves "too fast" compared to an average. The move is quantified and a number is produced that allows one to hypothesise a market behaviour within a certain time frame. So:

1) Stocks & Bonds move

2) An average is calculated

3) A band within which Stocks should trade given the bond's behaviour is calculated.

4) When Stocks trade +/- those bands then a trade can be put on. There is a time stop, a stop loss and a profit target based stop to manage the trade.

***I have gone off my infatuation with that group, mainly because I got the distinct impression that it was beginning to function like a cult of sorts (a benign one though) and i felt that voicing an opposing idea to the founder (Chair, may he live long...) would have been inappropriate. That was confirmed by a conversation with an East Coast based trader who worked for the group's founder, and who did indeed harbour the same impression as myself, but who thought that it would not have helped him to voice his opinion. Self censorship did not seem an intelligent way of conducting one's professional or personal life, so I let it go.

And after the spike, the window of opportunity is here again. Shorting Dax again @4977. Time limit for this to work is tomorrow morning by 9am GMT. If prices have not shown signs of breaking down by then position will be cut. This particular outlook is on a marginaly longer timeframe than previous short that was closed out earlier. Risk (stop) is 0.18% of portfolio.

And after the spike, the window of opportunity is here again. Shorting Dax again @4977. Time limit for this to work is tomorrow morning by 9am GMT. If prices have not shown signs of breaking down by then position will be cut. This particular outlook is on a marginaly longer timeframe than previous short that was closed out earlier. Risk (stop) is 0.18% of portfolio.

Well... the only reason I'm still standing is my willingness to take small profits, and the inability to leave any positions (especially ones that are based on short term market signals) open without my being there to watch prices. Covered the small short at 14:54 GMT @4852 only because I had to leave and pick up my son from his tennis practice. Just back and stocks have spiked on US consumer confidence numbers. In the short term better to be lucky than good. In the long term...

Well... the only reason I'm still standing is my willingness to take small profits, and the inability to leave any positions (especially ones that are based on short term market signals) open without my being there to watch prices. Covered the small short at 14:54 GMT @4852 only because I had to leave and pick up my son from his tennis practice. Just back and stocks have spiked on US consumer confidence numbers. In the short term better to be lucky than good. In the long term...

This is the very first chart, and the first signal I publish. The idea has come about mainly because of the need for sharing ideas. Trading is a tough endeavour, ask anyone who's involved in it full time, and the lack of resources that I feel since having being cast out of paradise ( or a full service investment bank with BBLG, research, people to share ideas with, and most of all customer flows...) has meant my having to scour the Internet for like minded individuals to communicate with about trading.

This is the very first chart, and the first signal I publish. The idea has come about mainly because of the need for sharing ideas. Trading is a tough endeavour, ask anyone who's involved in it full time, and the lack of resources that I feel since having being cast out of paradise ( or a full service investment bank with BBLG, research, people to share ideas with, and most of all customer flows...) has meant my having to scour the Internet for like minded individuals to communicate with about trading.

I'm not the first, and certainly will not be the last to try and put market timing thoughts in a public forum, and I'm not overly worried about egg on my face for possible failures, since I'm used to the fickle nature of trading.

A quick explanation: what I do is look for areas where a confluence of factors leads me to expect a certain type of market action, within a certain time frame. I look for the "overlay", that is I look for a particular type of market action caused by the interplay of different asset classes, and what comes about at t+1, t+n when my measures line up.

You won't find the exact methodology spelled out, because I have no interest or incentive in offering an exact explanation of how I calculate my stats. Suffice it to say that I am intimately involved with the methodology, I have calculated it and know what it does best, and when it is that it's likely to blow up.

What is do not use is TA, not because of any snob value, but because it does not stand up to the scrutiny of statistical analysis, and thus I do not feel I can construct a trading method that is based on any charting rules. Same goes for indicators, momentum signals, etc.

If you believe I'm wrong happy to hear from you, but please include numerical proof and statistical analysis to support your assertions.

Any ideas about trading methodology or other matters that have to do with making a buck (or Euro, Yen, GBP etc) feel free to share, I will endeavour to answer within a reasonable time frame. Complaints about the effectiveness or otherwise of my signals are not dealt with at all: this blog is not a money making venture, I'm not selling the signals and thus will not abide anyone who feels hard done by a trade gone wrong. These are my signals, and my trades, they are not an invitation for you to follow me into what may at times be a losing proposition.

Enough said, let's start.

The idea talked about earlier, of cutting when trade is not within certain parameters (in this case 6 bars from the trigger) has borne fruit, as Dax has come off sharply on the back of Mortgage delinquency figures in the US.

The idea talked about earlier, of cutting when trade is not within certain parameters (in this case 6 bars from the trigger) has borne fruit, as Dax has come off sharply on the back of Mortgage delinquency figures in the US.